HSC Board Exams are fast approaching and students are getting anxious about how to prepare for their HSC Board Exams. So we had mentioned some HSC Study Tips to help students in Cracking HSC Exams.

After the tremendous success of our last year Important Questions Bank for Gujarat HSC (12th Std) Board Exam 2016, we have also created a list of Most Important Question Bank for Gujarat (12th Std) HSC Board Exam 2017 which are likely to appear in HSC Board Exams this year.

To unlock the content Click on any of 3 buttons available in the box below saying “This content is Locked”. Once you click on the button the content will get unlocked on same page itself. You must click on social media button showing in below box ie Facebook, Twitter or Google Plus to unlock the content.

Hi, we’re trying to collate and gather the data and would be updating it here a few days before the exam. Please keep on visiting our website for updates.

Please use the comments box below and post questions that you think are important from your analysis. It would help the HSC community a lot.

Do subscribe to our updates so that you do not miss out on any important information that we push your way.

Element of Account Important Question Bank 2017 (English Medium)

Q1. A, B and C are sharing profits losses in ratio 3:2:5 from the following. Trial Balance and adjustments. Prepare trading A,/c. P&L Nc.,P&L Appropriation A/c.,., Partner’s Capital Accounts & Balance-sheet for the year ended on 3 I .12.05.

Adjustment:-

1. Closing stock is Rs.15,000 market value is 10% more.

2. Calculate interest at 10% p.a. on capital and 12% on drawing.

3. Goods of Rs.2000 are withdrawn.by C for personal use are recorded in Sales Book.

4. A brought his personal fixed assets worth Rs.20,000 on 1 .7.05 in business.

5. Depreciate fixed assets at 8% and furniture @ l0%o p.a.

6. Write off bad debts of Rs.5000 from debtors and provide bad debts reserve at 10%.

7.Commission to salesman is 1% on sales.

Q2. From following transactions prepare Bethomel for Samvat 2067 Chaitramas of Chailaly Stores, Prepare personal account in the Khatavahi.

Sud-l Cash Balance Rs.16900 and Bank Balance Rs.18,800.

Sud-3 Purchased goods of Rs.9000 at ll%oT.D. from Jaya, paid cheque for half amount.

Sud-5 All The goods purchased from Jaya are sold Rekha at 25% profit Sales price. (C.P. considered before deducting T.D.)

Sud-7 Rs.2300 sent with angadia Dineshbhai to be paid to our creditor Pravin Lal. Rs.20 paid for angadia kharch.

Sud-10 Goods of Rs.3000 returned by Rekha these goods returned to Jaya.

Sud-12 Received cheque from Rekha after deducting 5% cash discount to settled her account, this cheque is endorsed to Sapana.

Sud-15 Purchased furniture of Rs.1200 from Metro Furniture his dues are accepted by Kalpana Traders.

Vad-2 A Receipt is received from creditor Pravin Lal.

Vad-5 Rs.500 given on 3 to 4 days credit to Puja.

Vad-8 Bank has credited lts.300 for interest and debited Rs.100 for commission.

Vad-9 Rs.200 paid by some one, but his name is not recollected.

Yad-12 A debtor Mafat is declared insolvent a cheque of Rs.8000 received from his receiver as last dividend at 60 paisa per rupee. The cheque is deposited

Vad-13 Amount given to Puja on credit is not returned, so it is recorded in her account.

Vad-14 Paid Rs.200 in orphanage home on account of grand mother.

Vad-14 Paid Rs.300 gift on marriage of our customer’s son.

Vad-15 Kept Rs.1000 on hand and balance is deposited in bank.

From above transaction after recording in Bethomel prepare personal accounts in the Khatavahi of Chaitaly Stores.

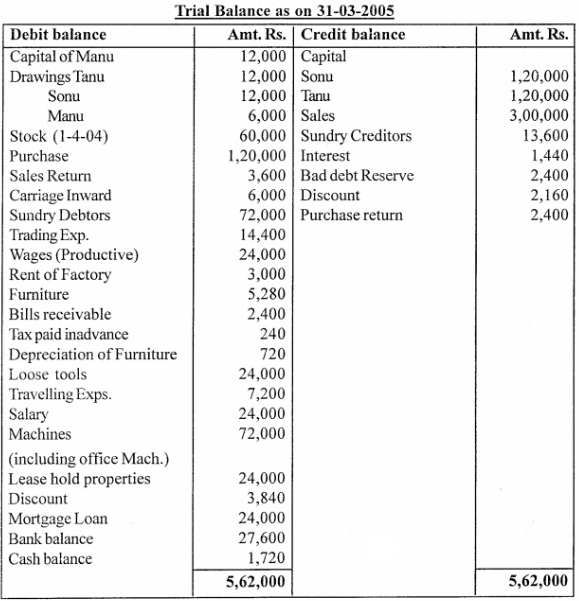

Q3. Sonu, Tanu, and Manu are partners. Their Trial balance on 3l-03-2005 and adjustments are given below, From those infonnation prepare their Final A/c.

Actrinstments:-

1. Closing stock is of Rs.90,000.

2. Interest 5oh on capital allowed or charged.

3. F-rom Divisible profit Manu gets first Rs.2400 & rest of the profit is divisible in2:2:1 ratio.

4. Manager is to be paid 10% commission on profit after charging his commission.

5. 5% depreciation on Machines and 10% on loose tools.

6. Salary Paid in advance Rs.2400.

7 . Bad debts Reserve is to be increased by Rs.4800.

8. Rs.1200 frorn Bills receivable are nov/ not recoverable.

Q4. The authorised capital of Krishna & Co. Ltd. was Rs.2,00,000 divided into 20,000 equity shares ofRs.10 each. The company issued all the share on which the amount was payable as follows :

On application Rs.5 (including premium)

On allotment Rs.4

On Call Rs.3

Money due on all the shares were received except allotment money on 200 shares and call money on 500 shares (which includes 200 shares on which allotment money was not paid).

The above 500 shares were forfeited and were re-issued at Rs.7. Give Journal entries.

Q5. Sarabhai Limited of Baroda issued 10,00,000 equity shares of Rs.10 each to public company called.

Rs.3.50 per share on application.

Rs.3.50 per share on allotment and

Rs.3.00 per share on first and final call.

Company received application for 12,00,000 equity shares from public. Excess application were rejected and money paid on them was refunded.

Kedar, who had full Rs. 10 per share along with application. Company Karan, who was allotted 1500 shares, had paid the share allotment money. Vinit, Who was allotted 1200 shares. Could not pay first and final call.

Except this, amount due on allotment and first & final call were duly received from time to time. Pass necessary journal entries in the books of company

Q6.D and P are partners sharing profit and less in the ratio of 3:2.Their Balance sheet as on 3l-12-2003 is as follows.

On 31 -12-03 firm was dissolved and following information is available.

1. D took away investment at Rs.8000 and accepted to pay loan of Mrs. D

2.realisation of assets were as stock Rs.4000, debtors Rs.17000, Furniture Rs.6000, Land & Building Rs.25000.

3. Dissolution expenses amounted to Rs.i000.

4. Creditors were paid at 10% discount.

Prepare necessary Accounts.

Q7. Prepare Motor Car Nc. creditors A/c. at the time of dissolution of Realisation A/c. is prepared by second method.

(i) Motor Car shown in the books at Rs.100000 and Rs.70000 is realised from its Sales.

(ii) Creditors are shown at Rs.70000 and they were paid off at 10% discount.

Q8. Explain the methods of dissolution of firm.

Q9. Explain the factors affecting valuation of goodwill.

Q10. State the difference between fixed capital and fluctuating capital.

Q11. Explain methods of Financial Statements analysis.

Q12. Method of Redemption of Debentures.

Q13. Write a formula to decide commission of a manager of a firm when his commission is paid on “Net profit after charging such commission.”

Q14. Why assets and liabilities of the firm are revalued ?

Q15. What is “Naked Debentures” ?

Q16. How are contingent liabilities shown in the balance sheet as per Companies Act.

Q17. Current assets Rs.7,40,000; current liabilities Rs.5,60,000; cost of goods sold is Rs.8,10,000. If the rate of gross profit is 10% on sales, then find out working capital turnover.

Q18. The accounting year of a firm is a calendar year. One partner has withdrawn uniform amount in the beginning of each month from 1st September. If total withdrawal is of Rs. 1920, what will be the amount of interest on withdrawal @ 12% p.a?

Q19. Write accounting treatment for following transactions in case of dissolution of a firm.

(i) Goodwill is not shown in the books but Rs.10000 realized from its sales.

(ii) Partner X has taken responsibility for dissolution process for remuneration of Rs.10000

Q20. State the provisions of Partnership Act.

Don’t forget to read : MUST REMEMBER THINGS on the day of Exam for HSC Students

Best of luck for your exams. Do leave a comment below if you have any questions or suggestions.

Gujarat class (12th Std) HSC Board Exam 2017

How can I download the question bank?