Accountancy – Important Questions Bank for Himachal Pradesh HSC 2016 Examination

We had mentioned some tips for cracking the HSC Himachal Pradesh (HP) exam here: HSC Study Tips to Crack HSC Exams.

We had also shared Important Questions Bank for HSC Examination 2016 and students have really appreciated it and showered us with love last year.

Today, we are posting the Accountancy – Important Questions Bank for Himachal Pradesh (HP) HSC 2016 Examination to make life easy for all you HSC students.

Without making you wait any further, please find the questions below:

(Analysis of Financial Statements)

1.From the following information prepare a Cash Flow Statement.

| Opening Cash Balance | 20,000 |

| Closing Cash Balance | 24,000 |

| Decrease in Debtors | 10,000 |

| Increase in Creditors | 14,000 |

| Sale of Fixed Assets | 40,000 |

| Redemption of Debentures | 1,00,000 |

| Net Profit for the year | 40,000 |

2. What are the limitations of Cash Flow Statement ?

3. Define the objectives of financial analysis.

4. What is the meaning and two objectives of trend analysis ?

5. From the following information calculate :

(a) Current Ratio

(b) Liquid Ratio

(c) Operating Ratio

6. Under the headings will you show the following items in the Balance sheet of a Joint Stock Company.

(i) Stock

(ii) Cash A/c

(iii) Trade Marks

(iv) Bills Receivable

(v) Debentures

(Accounting for not for Profit Organisations, Partnership and Company Accounts)

7. From the following Receipts and Payments A/c of a club and from the information supplied, Prepare Income and Expenditure A/c for the year ended 31st Dec. 2000.

(a) The club has 50 members each paying annual subscription of Rs. 25. Subscription outstanding on 31st Dec. 1999 were Rs. 300.

(b) On 31st Dec. 2000 salaries outstanding amount to Rs. 100. Salaries paid included Rs. 100 for the year 1999.

(c) On 1-1-2000 the club owned land and building valued at Rs. 10,000, furniture Rs. 600 and books for Rs. 500.

8. What is Receipt and Payment account ? What are its characteristics

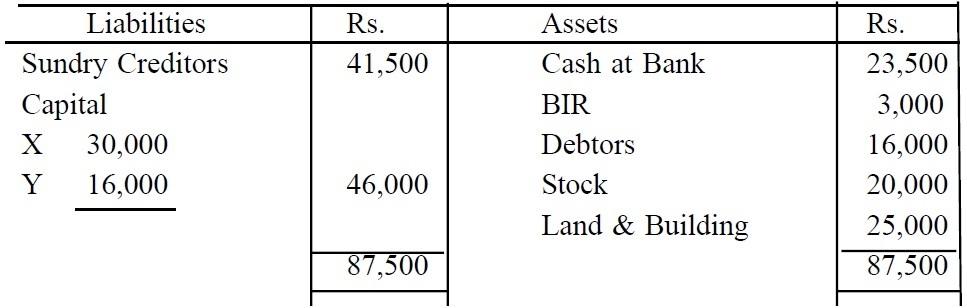

9. X and Y share profits in the proportion of 3:1. The balance sheet of the firm as on 31st Dec. 1998 was as follows :

On 1st January, 1999 Z was admitted into partnership on the following terms :

(i) That Z will pay Rs. 10,000 as his share of capital.

(ii) That Z will pay Rs. 5,000 for goodwill.

(iii) That the stock be reduced by 10%.

(iv) A provision at the rate of 5% be created both for bad and doubtful debts and the BIR.

(v) That the value of the land and building be appreciated by 20%. Prepare revaluation A/c and capital A/c.

10. What is goodwill ? Why does a new partner pay for it ? How is its value determined?

11. X Co. Ltd,. issued 10,000 shares of Rs. 10 each at Re. 1 Premium. The amount payable are as follows :

| Rs. | |

| on application | 3 |

| on allotment | 5 (including premium) |

| on first call | 2 |

| on final call | 2 |

Ajay who was holding 100 shares, did not pay his allotment and first call money. His shares were forfeited and Sanjay who was holding 200 shares did not pay first call money and his shares were subsequently forfeited. The share were forfeited after the first call is over and reissued to Mr. Gupta for Rs. 2,500 fully paid. Prepare the necessary Journal Entries

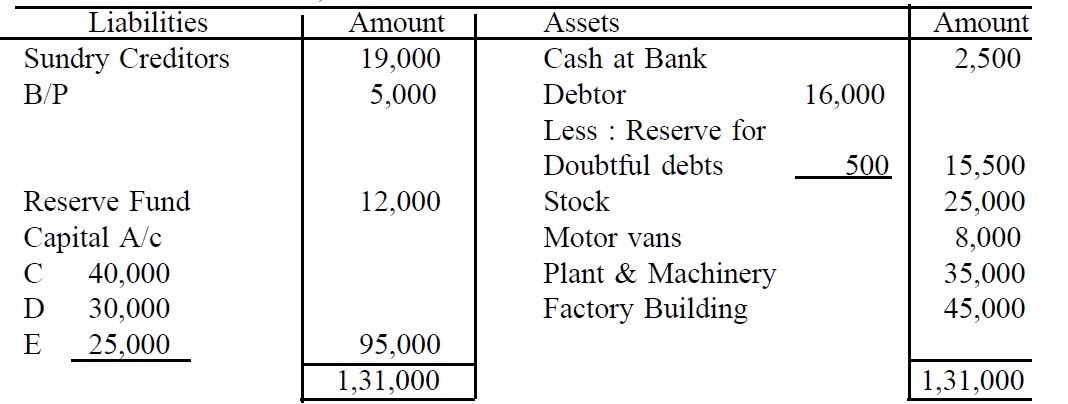

12. C, D and E were partners sharing profits in the ratio of 1/2, 1/3 and 1/6 respectively. The Balance Sheet of C, D and E as on 31st Dec. 1998 are as follows :

D retires on that subject to the following adjustments.

(i) Goodwill of the firm to be valued at Rs. 18000 and is to be written off later on.

(ii) Plant to be depreciated by 10% and Motor vans by 15%.

(iii) Stock to be appreciated by 20% and building by 10%.

(iv) The Reserve for doubtful debts to be increased by Rs. 1950.

Prepare Revaluation A/c, Capital A/c and Balance Sheet of the firm after CLS retirements

13. Explain in detail the adjustments of A/cs on the retirement and death of Partner.

14. What is Sinking Fund and why it is prepared ?

15. A company issued Rs. 10,000 10% Debentures on 1st Jan. 1997. Interest on these debentures is payable on 31st March and 30th September each year. Pass necessary journal for 1997 assuming that Income Tax is deducted @ 25% on interest and that accounts are closed on 30th September.

16. P and S are partners sharing profits and losses in the ratio of 3:2. Their books showed goodwill at Rs. 20,000. R is admitted with 1/5th share which he acquires equally from P and S. R brings Rs. 20,000 as his capital and Rs. 10,000 as his share of goodwill. Profit at the end of the year were the amount of Rs. 1,00,000. You are required to give journal entries.

17. What do you understand by Minimum Subscription and forfeiture of share ?

18. What is Gaining Ratio ? How it is calculated ?

19. How does the Income and Expenditure account differ from a Profit & Loss Account?

20. Give two distinctions between Share and Debentures.

21. State the four characteristics of debenture.

22. What do you mean by Pro-rata Allotment ?

23. Mr. Gupta is a partner in a firm. He drew regularly Rs. 1200 at the end of every month for the six months ending 30 June 2005. Calculate interest on drawing at 15% p.a.

24. What is Partnership Deed

Let’s try to make this a two way exercise. While we gather the question banks, you might have some inputs on this too! Please use the comments box below and post questions that you think are important from your analysis. It would help the HSC community a lot.

Do subscribe to our updates so that you do not miss out on any important information that we push your way.

You must share this link on your social media of Facebook, Twitter or Google Plus to unlock the content.

Don’t forget to read : MUST REMEMBER THINGS on the day of Exam for HSC Students

Best of luck for your exams. Do leave a comment below if you have any questions or suggestions.

Physics, Chemistry, Biology, Political Science ,

7 thoughts on “Accountancy – Important Questions Bank for Himachal Pradesh (HP) HSC 2016 Examination”